Zero to One

Ideology of competition

Competition is a destructive force. It is not at all clear why these 2 companies are competing. Sometimes you do have to fight, when you do either don’t throw punches or strike hard and finish it ASAP.

last mover advantage

The value of a business is the sum of all the money it will generate in the future discounted to it’s present value. Build a monopoly which can grow and endure value in the future. A lot of people overlook the endurance part as it is not easy to measure unlike growth. Numbers don’t give a picture of endurance as shown by Zinga, Groupon. It is qualitative and a monopoly consists of some combination for the below key pillars

- proprietary technology - google search

- has to be at least 10x better in some important aspect, anything less is marginal improvement.

- network effects - facebook

- has to be valuable to first users with no/small network.

- should start small.

- economies of scale - the only lemon store in town however great it may be does not have sufficient scale for a monopoly

- brand - apple

- branding alone can never build a great tech business, it needs to have substance in underlying product.

Building a Monopoly

- start with a small niche market and build a monopoly there

- will have no or little competition

- gradually expand to adjacent bigger markets

- amazon is a great example. started with books then expanded to CDs, video games, software and then further.

- don’t disrupt. avoid competition as much and as longer as you can.

There is no value in being a first mover in a market if someone else comes and leaves you behind. Moving first is a tactic, not a goal. Be the last mover in a market to make a significant development and enjoy monopoly profits for decades.

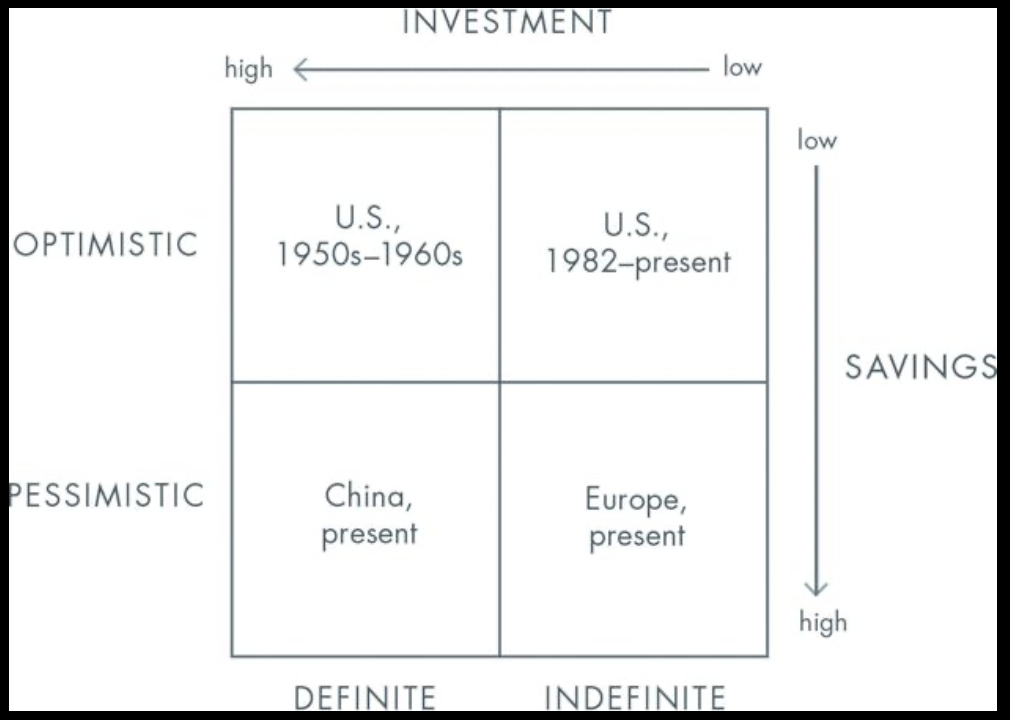

You are not a lottery ticket

Most people don’t have definite plans for life and just try to be merry, hope for the best and live it expecting randomness. You are either optimist or pessimist about the future. I am an optimist. indefinite optimism does not work - you don’t have savings and don’t know what to invest on. It is bound to end in misery/disappoinment.

Most people don’t have definite plans for life and just try to be merry, hope for the best and live it expecting randomness. You are either optimist or pessimist about the future. I am an optimist. indefinite optimism does not work - you don’t have savings and don’t know what to invest on. It is bound to end in misery/disappoinment.

definite optimist is the only option for folks like me - build the future I want. Just “the future is gonna be great” does not work, you need to build it “The future is gonna be great as I am gonna build it”

With a definite view of the future, money is cheap wheareas in an indefinite view it is everything. Very few people have definite views of the future and this is very very valuable!

Follow the money

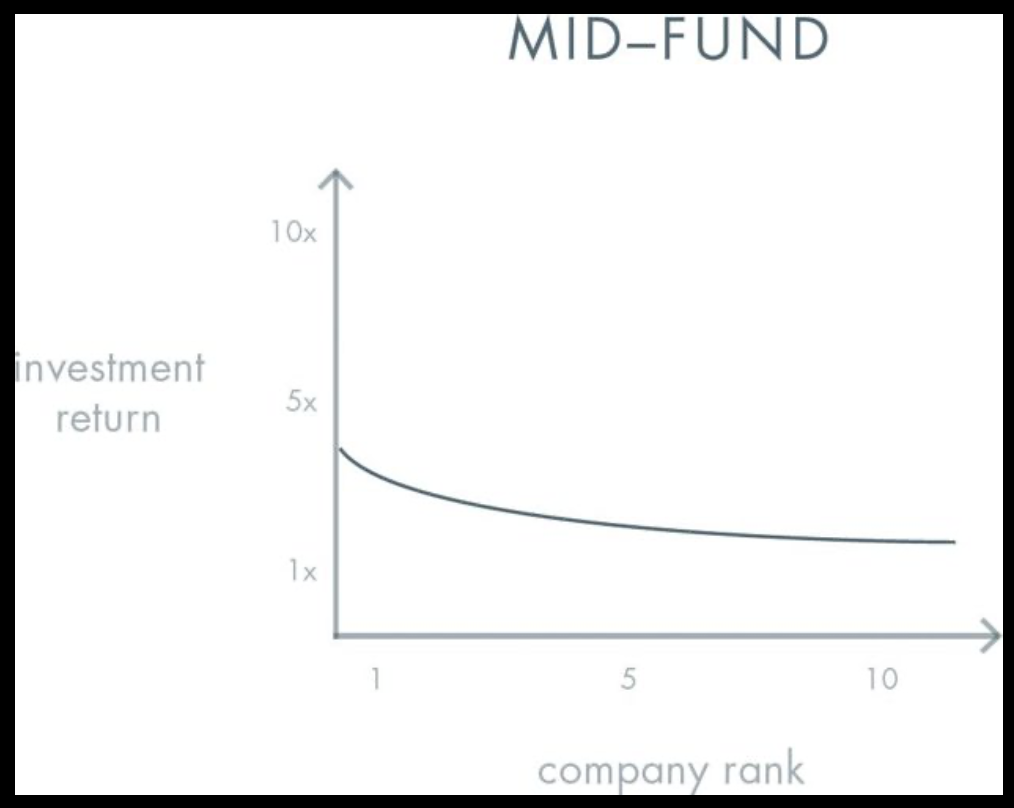

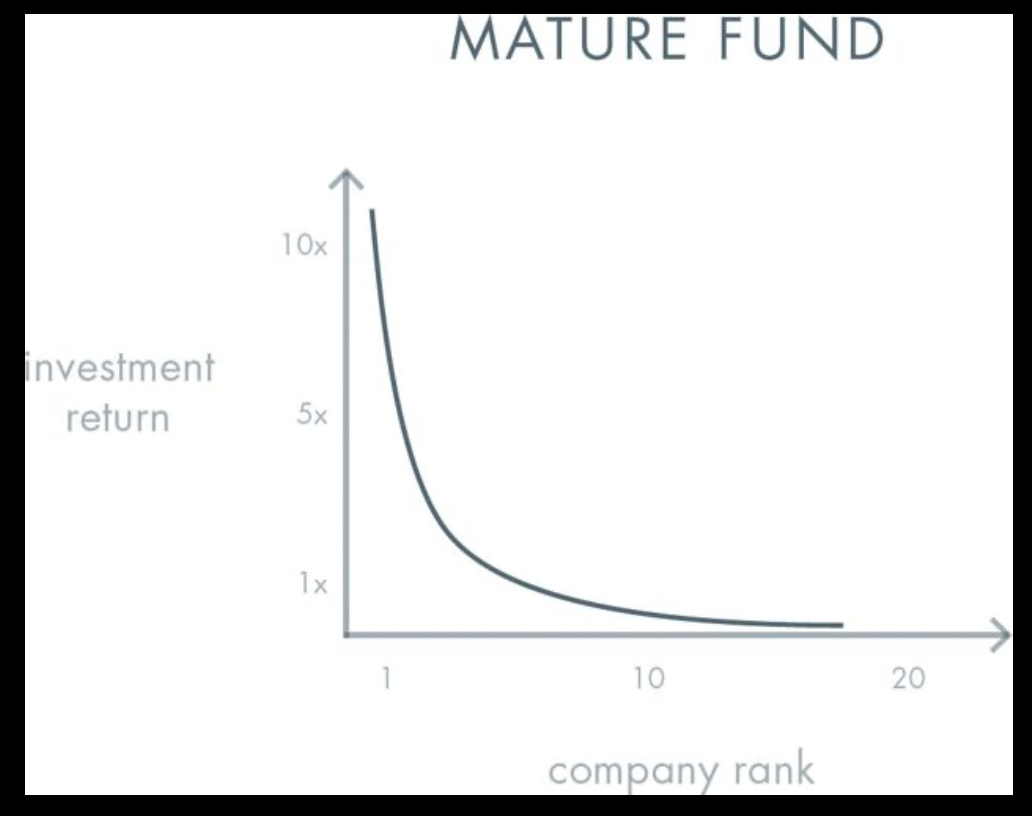

Money makes money. Compounding is the 8th wonder in the world. The best investment in a VC fund returns more than that of all others combined. This is the power law. You have to bet with size, if the highest multiple return is too small an investment it will not be sufficient. Founders fund invests each fund into 6-7 companies only.

Even VCs who see the power law so closely miss it. All companies look almost similar even at mid fund, but by the end of the fund, the power law is very very clear.

only 1 % of new businesses in US are venture funded. total VC investment accounts for less than 0.2% of GDP. But these employ 11% of the private workforce, is about 12% of the GDP. The top 12 companies by m.cap are worth more than all others combined!

The traditional parlay that “it doesn’t matter what you do, as long as you do it well” is completely false. It does matter what you do. You should focus relentlessly on something you’re good at doing, but before that you must think hard about whether it will be valuable in the future.

For the startup world, this means you should not necessarily start your own company, even if you are extraordinarily talented. The power law means that differences between companies will dwarf the differences in roles inside companies.

In a power law world, you cannot afford not to think hard about where your actions fall in the curve.

secrets

in the classic trichotomy of easy, hard and impossible most people believe that easy things are done and the pending ones are impossible. They do so because of 4 primary reasons

- incrementalism - pounded from childhood to adeloscence

- risk aversion - scared of being wrong

- complacency - “Social elites” believe in secrets the least

- flatness/globalization - in this world so huge obviously someone smarter than me would have thought about this

examples of recent secrets

- There might still be hidden injustices. In the 1900’s most people didn’t see slavery as evil, today it is the convention.

- most people did not believe the bubbles in 1999 and 2005.

You can’t find secrets without looking for them, Andrew wiles proved Fermat’s last theorem after it being unsolved for 358 years. The ideas for most of the recent great companies seem obvious in retrospect, this points to there being a lot more secrets.

The best place to find secrets is where no one is looking.

Theil classifies secrets into 2 kinds, people secrets and nature secrets. Physics has been there for 100s of years and every university has a legitimate department for the same. You can say solve nutrition - no university has a nutrition department and there are real holes in our understanding of it today.

Tell secrets only to people you need to.

Foundations

A startup messed up at it’s foundation cannot be fixed.

If you don’t have a history with your co-founders, you are just rolling dice. Founder conflict is just as ugly as divorce.

components of a business

- ownership - who owns company’s equity

- possession - who runs the day to day affairs

- control - who formally governs the company’s affairs

these are in disarray quite often

- DMV - you have ownership, goverment has control, but the guy who has possession rules it.

- GM CEO - very little ownership, has control - is incentivised by short term profits over long term investments

Ideal board size for a startup is 3, max is 5. If you want an effective board - keep it small, if you want dictatorship - keep it huge.

You are either on the bus or off the bus. Avoid part time people, contractors - their incentives are misaligned, are there to extract current value and not create long term value.

In no case should a CEO of an early-stage, venture-backed startup receive more than $150,000 per year in salary.

Cash poor CEOs are incentivized to create value, cash rich ones are incentivized to maintain the status quo. Bonuses are relatively better as they reward a job well done.

everyone’s value add is different and hence should have different equities. Keep it a secret to avoid chaos.

Mechanics of the Mafia

no company has a culture; every company is a culture.

The relationships b/w people working in a startup should be beyond transactional, you should enjoy working with your co-workers. If you don’t have meaningful relationships, you haven’t invested your time well - even in purely financial terms.

Initial employees are lured with prominent roles and high equity. Why should the 20th employee join you?? Avoid generic answers like equity will be valuable, change the world etc, they don’t help you stand out. Every good answer is specific to the company - the best answers are either about the team or the mission.

From the outside, everyone in your company should be different in the same way.`

helps the team work quickly and effectively together.

On the inside, every individual should be sharply distinguished by her work.

Every employee should do only one thing and he should be aware that he will only be evaluate based on that - simplifies management and reduces conflict.